guaranteed income for life

Mel Gambrell

I Recommend Lifetime Guaranteed Annuities Not’

For What They Might Do…

But For What They Are Contractually Guaranteed To Do!

Free Consultation

919 – 519 – 2721

Americans want lifetime income security

That Only Annuities Can Provide!

A recent Black Rock Report found….

***Adding guaranteed lifetime income combined with a more aggressive asset allocation generates 29% more annual spending ability from one’s retirement savings (excluding Social Security) and reduces downside risk by 33%.****

Dr. Michael Finke, Ph.D. is a Professor of wealth management and Frank M. Engle Distinguished Chair in Economic Security Research at The American College of Financial Services

Dr. Michael Finke says: Annuity Education Must Take Center Stage For Advisors To Meet The Demand For Protection In Retirement.

Dr. Michael Finke says: Americans want the lifetime income security that only annuities can provide.

93%

93% of consumers who protected their portfolio with an annuity in 2022 are satisfied with their investment choices.

PRIP Report

42%

42% of financial professionals who changed their retirement planning approach in the past year are putting more into annuities now.

90%

Nearly unanimous: 9 in 10 investors

say it is important that their retirement income plan is designed to provide

a guaranteed income payment or principal protection

9 in 10

81%

Advisors rate the importance of retirement income protection higher (81%) than asset growth protection (66%).

AS PRIVATE SECTOR PENSIONS DISAPPEAR

GEN X TURNING TO ANNUITIES

AT HIGHER RATES IN SEARCH OF

PROTECTION

This Is Not Rocket Science It's Safe Money Science.

Companies are no longer providing Pension Protected Income. I’ll help you create a Private Pension Plan…. an income you can never outlive!

So...What Is Safe?

So…What Is Safe?

If you ask the typical fiduciary, stockbroker, money manager, or mutual fund rep.

The answer given is almost unanimously bonds!

While I agree Bonds are safer than stocks… Bonds are still subject to market volatility.

Click on the link below & you’ll be able to view the historical data for Bonds (& Stocks) by way of Portfolio Visualizer.

https://www.portfoliovisualizer.com/backtest-asset-class-allocation#analysisResults

This is a free tool anyone can use.

When managing my personal investment portfolio I often rely on the data, portfolio visualizer provides. (Note this isn’t an endorsement of PV)

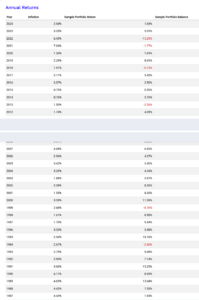

As you can see the Bond market was in the red (negative) during the years 2023, 2021, 2018, 2013,1999,1994!

5 negative years out of 38

Just in case you are wondering how many negative years in the stock market. According to portfolio visualizer, we had negative years in:

2022, 2018, 2008, 2002, 2001, 2000, 1994, 1990,

8 negative years out of 38

2018 was a double negative because both stocks and bonds were in the red.

Yes, Bonds are safer than stocks but as you can see bonds are also subject to market volatility.

A Bond portfolio isn’t my choice for a safe portfolio!

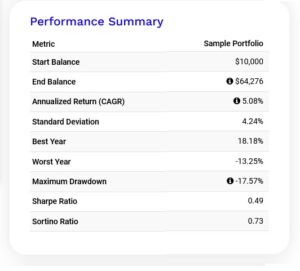

When you look at the chart below you’ll notice bonds have an annualized return rate (CAGR) of 5.08% over the last 38 years.

Remember: Everything I’m showing with these charts you can view for yourself by clicking the “PV” link above (or copy and paste)

If you are dealing with a financial advisor and the word guarantee is not a part of their lingo my recommendation is to find a different financial advisor.

It doesn’t matter how fancy they get with their words it doesn’t matter about all the Monte Carlo simulations they show you.

No financial advisor knows the year when you are going to receive a negative in your account no one knows how many years in a row you might experience a negative in your account no one knows how many negative years you are going to experience during your total retirement years.

So if the word guarantee is not a part of their vocabulary…. if they are not advising you to have a portion of your money guaranteed for life, you need to find a different financial advisor.

How can you be a fiduciary financial advisor and not recommend securing at least a portion of a client portfolio with a product providing a pension-like income guaranteed for the rest of their life?

Fiduciaries automatically have a conflict of interest even though their fiduciary status is supposed to Shield them from conflict of interest. They automatically have a conflict of interest if they are not recommending annuities as part of your portfolio.

Annuities are commission-based products & as a result, the vast majority of fiduciaries don’t recommend them….. This creates an automatic conflict of interest.

Believe me when I tell you I have heard some slick verbiage from various different so-called conflict-free fee based only fiduciaries but no matter how slick sounding they are…. it doesn’t matter how many years of experience they have there’s only one word you need to keep in mind when speaking with a Financial Advisor… and its the word “guarantee”…

Let me give you three words…..

“Guaranteed For Life”

If your financial advisor isn’t willing to put a portion of your retirement income into a product that will guarantee you never run out of money, you need to look for a different financial advisor.

I Recommend Annuities Not' For What They Might Do But For What They Are Contractually Guaranteed To Do!

I recommend annuities not based on what they might do but on what they are contractually guaranteed to do.

The annuities I recommend the majority of the time don’t have any fees. 100% of your money is going towards compounding interest

The type of annuity I recommend the most also compensates the advisor with the least amount of commissions its called a MYGA – Multi Year Guaranteed Annuity!

The most popular annuities are FIA’s – fixed indexed annuities with lifetime guaranteed Riders on them. These annuities pay the highest Commission and that is why you probably hear the phrase fixed indexed annuities or FIA’s, the most.

With an FIA you have a minimum rate guarantee and your gains are locked in each year. The minimum guarantee in an FIA is usually much lower than the minimum guarantee on a MYGA!

However, unlike the MYGA, the FIA has the potential for higher rates or returns and the FIA is usually the delivery system for the “Guaranteed Income Rider” An FIA with the rider on it has a fee charge similar to the fee charged on your managed brokerage account, 401k/IRA etc etc etc.

I personally don’t like paying for something unless I have to.

When you purchase an FIA, if you are not activating the “Income Rider” until several years later….Why pay for it today?

2nd! The money held inside of your annuities bucket is supposed to be your “SAFE MONEY” bucket.

YES! An FIA is safe however your rate of return can go up and down. Your rate of return could be lower than a MYGA and it could also be higher than a MYGA.

In order for the FIA to outperform the MYGA the rate of return has to account for the fee charge of the FIA….. remember, the MYGA doesn’t have any fees.

If I have a MYGA with a guaranteed rate of 5.8% with no fees you’ll need to average at least 6.8% in the FIA just to break even!

For me, to make it worth the constant ups and downs of the market I would be disappointed if my rate of return wasn’t at least 7.5% with the FIA!

The question I ask myself and the question you need to ask is this: Is it worth it? Is having the FIA prior to turning on your guaranteed income for life… worth the risk of underperforming the guaranteed rate provided by the MYGA with no fees?

****YES! I get a ton of hate emails from annuity advisors over my common-sense approach to recommending annuities lol*****

However, to me, it doesn’t make sense to put your safe money into a product that might be higher or might not be higher, at the end of the rainbow when I can simply guarantee you a rate of return for….. “x” amount of years and when it’s time for you to flip on the switch for the lifetime guaranteed income then we can look at switching to an FIA with an Income Rider or a SPIA.

Very few Advisors recommend this common-sense strategy and I’m ashamed to say the reason is more than likely a result of the lower MYGA commissions.

MYGA to “Future Income Rider” is my primary safe money recommendation!

BUT WAIT, MEL…. With an FIA you can’t lose money!

Wrong***

With an FIA you absolutely can lose money! The details is in the verbiage.

True, with a zero is your hero floor strategy lol meaning you have a minimum floor of zero percent.

If the market returns a negative -30% you will not participate in the loss, however, you will not have a gain either your rate of return would be zero.

If your rate of return is zero but you still have to pay the fees of let’s say 1%…this one percent is posting against your zero percent rate of return which means you just lost 1%

Trust me, I get it… for all you FIA diehard Advisors… losing 1% is much better than losing 30% I’m with you on this.

But to say you can never lose money in an FIA with a zero percent floor just isn’t true!

I only bring this up because the “Zero Is Your Hero” pitch is a part of every FIA recommendation and this should stop effective yesterday!

This is why I recommend annuities not based on what they might do but on what they are contractually guaranteed to do.

This is not rocket science it’s safe money science.

You Should Not Have All Of Your Money In An Annuity

If your Financial Advisor has you putting 100% of your money into an Annuity….

***STOP WHAT YOU ARE DOING***

Give me a call ASAP.

It’s 100% unethical to advise a client to place all of their money into an annuity!

I typically use the “Rule of 100 or the updated Rule of 110” to help a client determine how much should be in the safety bucket vs the growth bucket.

Simply subtract your age from 110. If 70… 110 minus 70 is 40! For a typical 70-year-old 40% of your portfolio can be in stocks while 60% of your portfolio should be in safe.

If 30 you can have 80% in stock while only 20% in safe!

If a few years away from retirement or in retirement you should have enough money in safety (Annuities) to make sure all of your basic necessities are taken care of and guaranteed for life.

Look at it like this….. The money from your guaranteed income annuity is your paycheck & the money from the stock portion of your portfolio is your play check your fun money.

A retirement expert by the name of Tom Hegna wrote a book titled “Pay Checks And Play Checks”…

It’s an awesome read I certainly recommend you pick it up I have a link to the book on my front page website.

In short….I’m a Certified Retirement Specialist with a focus on ensuring the safety of your retirement income.

I will handle your *Guaranteed Paychecks* while your investment-only advisor handles your play checks!

1000’s Of Hours In Research

What the Academic Studies Say!

What We Do

More Services We Offer

FBI-P-Plan

The Foreclosure Bankruptcy Income Protection Plan. The Life Insurance Policy You Can Use While You Are Living!

ACA Health Insurance

Zero Premium plans are available For 67% of those who apply! $99 Premiums & below are available for 93% of those who apply!

QLE’ If you have a Qualifying Life Event you can change your plan each month of the year via an SEP’ Special Enrollment Period.

Term Life Insurance

You’ are overpaying for Term Life Insurance. WHY? Find out how you can save thousands over the term of your coverage. We have the Top 100 plus companies on the market providing you the best rates on the planet!

Got a Project in Mind?

Let’s Work Together!

Contact Us

Call us at (919) 519-2721 or fill out the contact form at this website for a free consultation

Discuss the Works

Discuss you nees with one of our financial professionals.

Leave the Rest to Us!

Let us help you design a Retirement Income Plan that is Guaranteed For Life!